Railroad retirement calculator

Using the AIME calculate. Social security benefits that may be taxable to you include monthly retirement survivor and disability benefits.

Work With Governmental Reports

Our Retirement Estimator generates employee and spouse annuity estimates based on the employees railroad service and compensation and any social security wages on.

. Assuming employees have similar work histories and receive maximum monthly benefits a person receiving Railroad Retirement would collect 2700 a month. It provides retirement survivor unemployment and sickness benefits to individuals who have spent a substantial portion of. Click Retirement Plan Income in the Federal Quick.

Boarding for Railroad Retirement A simple 3-step process showing how you can improve retirement success lower your tax bill. Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free. Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free.

When you work in the railroad industry the Railroad Retirement Board keeps your earnings record. If you have spent 30 years in Railroad retirement and you are 60 you get the awesome benefit of receiving your retirement benefits early. In general its 0007 times the average monthly earnings.

When your spouse turns age 60. The Railroad Retirement program was established in the 1930s. Average of 60 Highest Earnings Months X Years of Creditable Railroad Service X 007 Tier 2 Monthly Benefit Example.

Railroad Retirement Board William O. They dont include supplemental security income SSI. The formula for the gross tier II amount is 710 of 1 of the employees average monthly railroad earnings up to the tier II taxable maximum earnings base in the 60 months.

Lipinski Federal Building 844 North Rush Street Chicago IL 60611-1275 Toll Free. The Railroad Retirement Board RRB is an independent agency in the Executive Branch of the Federal Government. On smaller devices click in the upper left-hand corner then click Federal.

Tier 2 monthly amount will be something like 0007 times the total amount you earned divided by 60 months multiplied by your 5 years. The Railroad Retirement Program is a federal program that extends retirement benefits to railroad employees. Casey Jones60 years old is a railroad professional of.

Under Social Security the. If a railroader has at least 30 years of. 90 of the first AIME bend point plus 32 of the amount in excess of the first bend point but less than or equal to the second bend point plus 15 of the amount.

It was started in the 1930s to nationalize railroad. The RRBs records are updated annually on the basis of employer reports. The program was established in the 1930s and in addition to.

Railroad Retirement Board William O. Railroad Retirement Board William O. From within your TaxAct return Online or Desktop click Federal.

The RRB computes benefit estimates on the basis of its record of the employees service and earnings. To be eligible for Tier 1 Retirement Benefits a railroader must have worked at least 10 years in covered railroad service or at least five years after 1995. Our goal for this process is to demonstrate in plain.

Effective January 1 2002 you must have either a total of 10 or more years 120 service.

2

Netsuite Vs Quickbooks 2022 Comparison Forbes Advisor

/income-tax-4097292_19201-45a89f65565f4c1c885c8eaaa92b4744.jpg)

Earned Income Definition

2

Retirement Plan Consulting Fiduciary Compliance Gallagher Usa

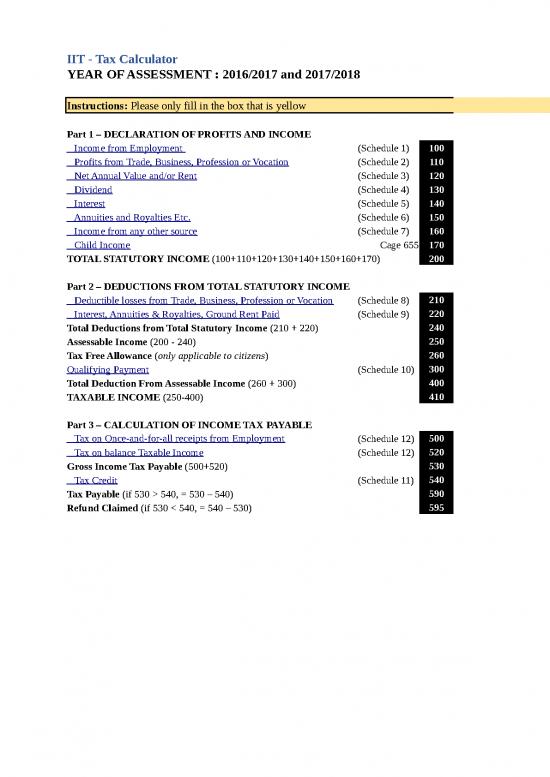

Schedule P Calculator

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

Railroad Retirement Party Chalkboard Quote Art Retirement Parties Art Quotes

Freight Railroad State Data Association Of American Railroads

Candicakes Over The Hill And Retirement Railroad Retirement Party Ideas Retirement Cakes 40th Birthday Cakes

![]()

Freight Railroad State Data Association Of American Railroads

2

Freight Railroad State Data Association Of American Railroads

Will Inheritance Affect My Medicare Benefits

2

Accountants Honing Your Technical Skills Abilities

How To Choose The Perfect Accounting Career Path For You